Two people shaking hands over documents on desk." width="1200" height="792" />

Two people shaking hands over documents on desk." width="1200" height="792" /> Two people shaking hands over documents on desk." width="1200" height="792" />

Two people shaking hands over documents on desk." width="1200" height="792" />

After doing all the hard work, getting paid makes it worth it.

Simplifying your payment processes is crucial to maintaining your company’s financial health and a stable cash flow. To do this, you need to be able to process as many payment types as possible, including:

In this blog, you’ll learn all about the QuickBooks Online ACH payment process, from dealing with individual sales receipts and invoices to setting up recurring payments.

Whether you’re new to QuickBooks Online or looking to optimize your current payment methods, follow these quick steps to learn how to process ACH payments in QuickBooks Online and enhance your business’ financial operations.

Let’s get started!

ACH payments are electronic payments made directly between banks through the Automated Clearing House network. It’s a popular way to transfer money without using:

This method works for business-to-business (B2B) and business-to-consumer (B2C) transactions.

There are two types of ACH payments — you can think of them as “pulls” and “pushes.”

An ACH debit is a type of ACH payment that pulls funds electronically from a bank account. In QuickBooks Online, businesses commonly use this method to collect payments from clients.

An ACH credit is the opposite of an ACH debit. Here, you push funds from your bank account to another account. You can use this method to:

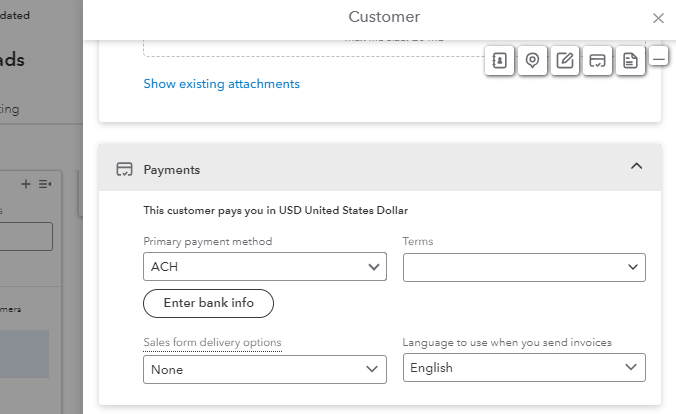

Here’s how to process ACH payments in QuickBooks Online:

You can process bank transfer payments for new invoices or sales receipts and for recurring sales receipts.

Once you schedule ongoing ACH payments, you’ll receive the funds every period, provided your customer has sufficient funds in their bank account.

Here’s how you set them up:

If you need to update a recurring sales receipt, click “Save template” to keep the customer’s payment details.

Before saving any details, ensure you have your customer’s consent. Print an ACH authorization form and have the customer complete and sign it.

QuickBooks automatically generates this form from the details you just entered. You can easily download and reupload it once your customer has signed.

That’s it! Now you know how to process ACH payments in QuickBooks Online.

ACH deposits take between two and seven business days. Recurrent ACH payments take less time after the first transaction with an account.

QuickBooks helps you with online payments and accounting processes. Method:CRM helps you grow your business and get new customers. Together, they make an unstoppable team.

Method’s powerful integration with QuickBooks ensures you manage your business from end to end. It makes it easier to convert prospects into clients and make the most of every sales opportunity. Method offers:

QuickBooks charges a 1% processing fee for every ACH transaction. QuickBooks deducts this transaction fee immediately after funds reach your account.

You may also get an email notification about other fees, which QuickBooks deducts on the fifth business day of next month.

EFT stands for electronic funds transfer and is a broader term for all digital payments. ACH is a specific type of EFT that is run between financial institutions through the Automated Clearing House network.

Yes, QuickBooks Online can handle split ACH payments, which lets you divide a payment between different accounts. You can see your split payments under “Transaction List with Splits” in the “Reports” tab.

See how you can extend the limits of QuickBooks with Method.

Image credit: Credit Commerce via Pixabay